Are There Fences in the Global Factor Zoo?

Regional and global factor momentum signals outperform local factors in forecasting risk premiums and revitalize momentum investing in less-integrated markets like Japan.

Habilitation, 2024

University of Liechtenstein

PhD Economics, 2015

University of Innsbruck

MSc Business Admin., 2007

University of Innsbruck

MSc Techn. Mathematics, 2007

University of Innsbruck

| Logo | Description |

|---|---|

my crypto2-package to retrieve

survivorship bias free cryptocurrency data from

coinmarketcap.com | |

my ffdownload-package to retrieve

research data from

Kenneth French's famous website | |

my rqmoms-package to calculate

option-implied moments according to

Grigory Vilkovs's python package |

Regional and global factor momentum signals outperform local factors in forecasting risk premiums and revitalize momentum investing in less-integrated markets like Japan.

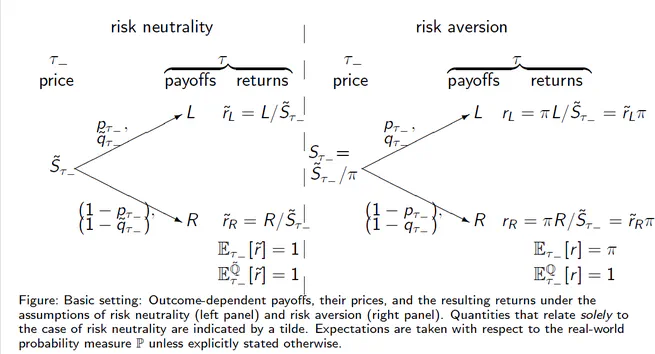

We analyze event risk premia in an expected utility framework and provide closed-form solutions under both quadratic and power utility for four different cases: Deterministic/stochastic conditional event returns, and deterministic/stochastic event outcome probabilities.

We document a cross-country factor momentum anomaly, which we term ‘Factor Chasing’. Specialized style mutual funds chase factor returns across countries, but their trades are delayed, leading to positive returns that are not spanned by leading factor models.

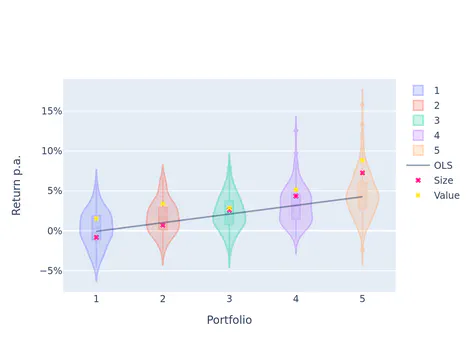

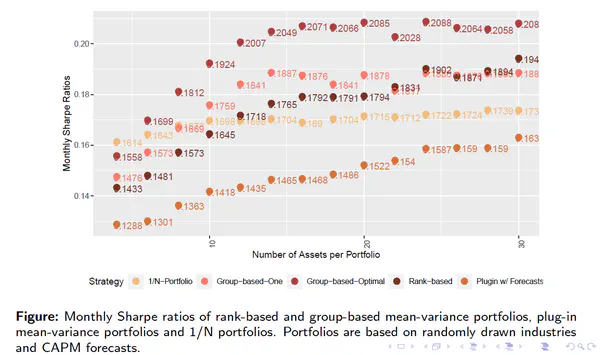

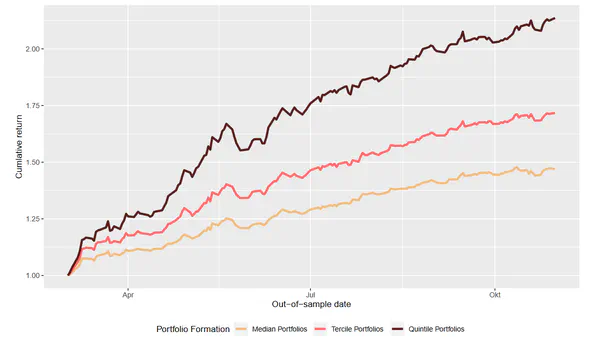

We offer a novel approach that aims at mitigating the crippling effects that parameter uncertainty and estimation errors have on the out-of-sample perforance of mean-variance optimized portfolios. We argue that investors should not rely on exact forecasts when optimizing portfolios but instead base their optimizations on ranking or grouping information and thereby implicitly reduce the informational content of their parameter inputs.

We estimate crypto-related risk for U.S. banks using historical covariance with bitcoin returns, focusing on contagion from FTX’s failure.

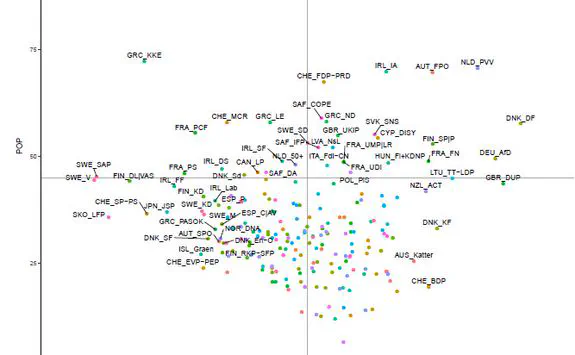

We examine the effect of populism on financial markets around national elections. We find that the electoral success of populist parties has a direct impact on volatility in major domestic market indexes with different signs depending on the political ideology of the populist parties.

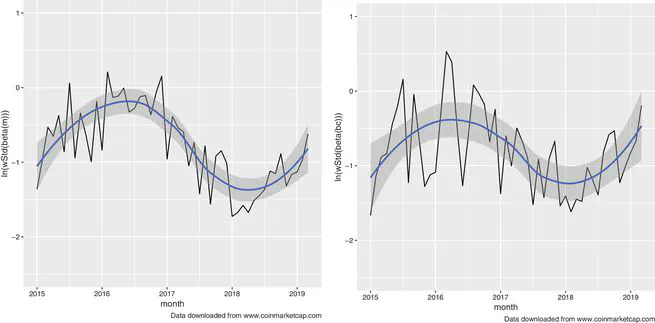

This paper investigates herding behavior in the crypto market. We consider the full, survivorship-bias free cross-section of cryptocurrencies, and document - against existing evidence - significant herding in this dataset. The effect is stronger, when using bitcoin as a transfer currency.

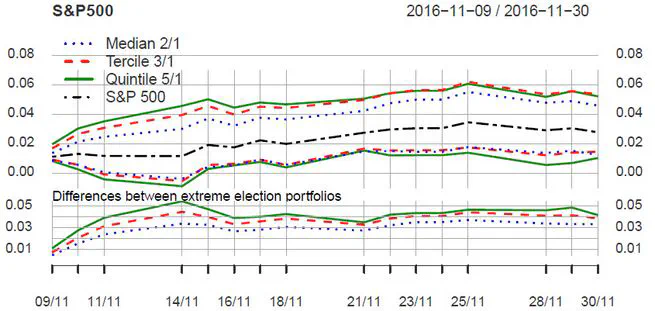

We use data from betting markets to analyze the sensitivity of stock returns to potential outcomes of political events such as elections. By classifying stocks into expected conditional winners and losers prior to such an event, we form portfolios that generate large positive returns after the event date, conditional on correctly anticipating the outcome. We illustrate this using data from the 2016 US presidential election and the 2016 Brexit referendum.

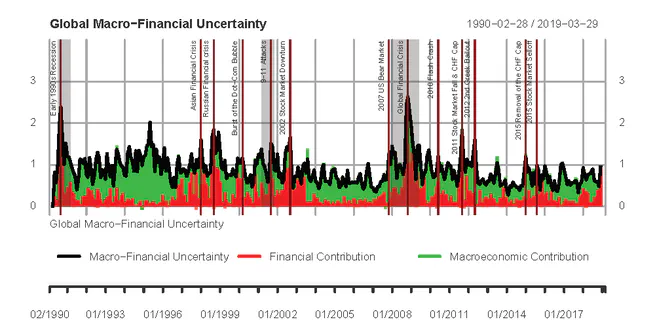

This paper introduces a novel measure of global macro-financial uncertainty and examines the state-dependent transmission of uncertainty to economic activity.

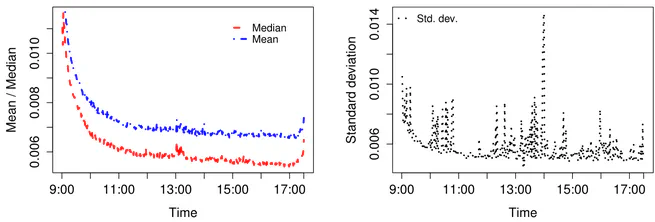

This paper explores the statistical and economical significance of intraday and -week patterns in bid-ask spreads.

Reach out via email or directly book an appointment.

Fürst-Franz-Josef-Strasse

Vaduz, 9490

Liechtenstein

Monday 11:00 to 12:00

Otherwise book an appointment