Event Risk Premia and Non-Convex Volatility Smiles

2024-01-01·, ,·

0 min read

,·

0 min read

Michael Hanke

Wolfgang Schadner

Sebastian Stöckl

Alex Weissensteiner

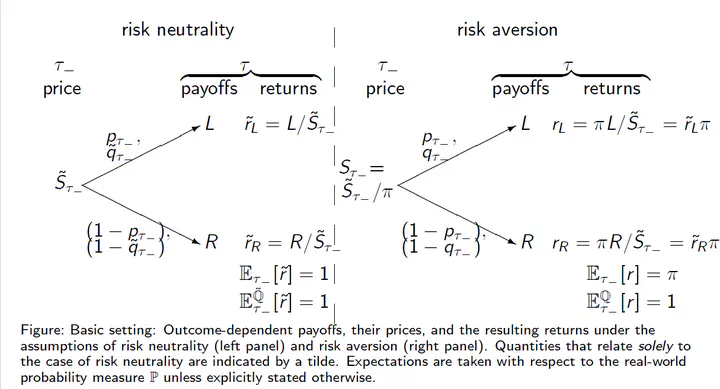

Outcome-dependent payoffs, their prices, and the resulting returns under the assumptions of risk neutrality (left panel) and risk aversion (right panel). Quantities that relate solely to the case of risk neutrality are indicated by a tilde. Expectations are taken with respect to the real-world probability measure unless explicitly stated otherwise.

Outcome-dependent payoffs, their prices, and the resulting returns under the assumptions of risk neutrality (left panel) and risk aversion (right panel). Quantities that relate solely to the case of risk neutrality are indicated by a tilde. Expectations are taken with respect to the real-world probability measure unless explicitly stated otherwise.Abstract

We analyze event risk premia in an expected utility framework and provide closed-form solutions under both quadratic and power utility for four different cases: Deterministic/stochastic conditional event returns, and deterministic/stochastic event outcome probabilities. Applying the model to parameters of event return distributions estimated in previous literature yields plausible ranges for event risk premia. We also explore conditions under which the model leads to concave volatility smiles.

Type

Publication

Working Paper (University of Liechtenstein & Free University of Bozen-Bolzano)