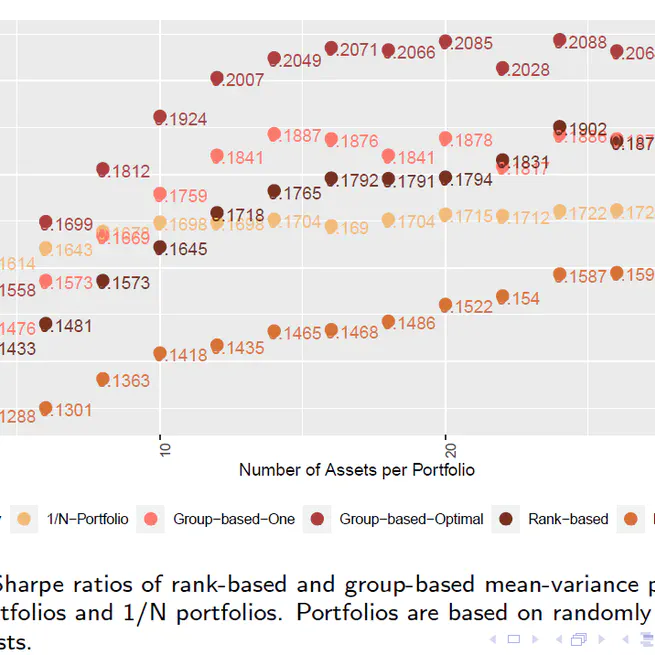

Less Is More: Ranking Information, Estimation Errors and Optimal Portfolios

We offer a novel approach that aims at mitigating the crippling effects that parameter uncertainty and estimation errors have on the out-of-sample perforance of mean-variance optimized portfolios. We argue that investors should not rely on exact forecasts when optimizing portfolios but instead base their optimizations on ranking or grouping information and thereby implicitly reduce the informational content of their parameter inputs.

2024-01-01

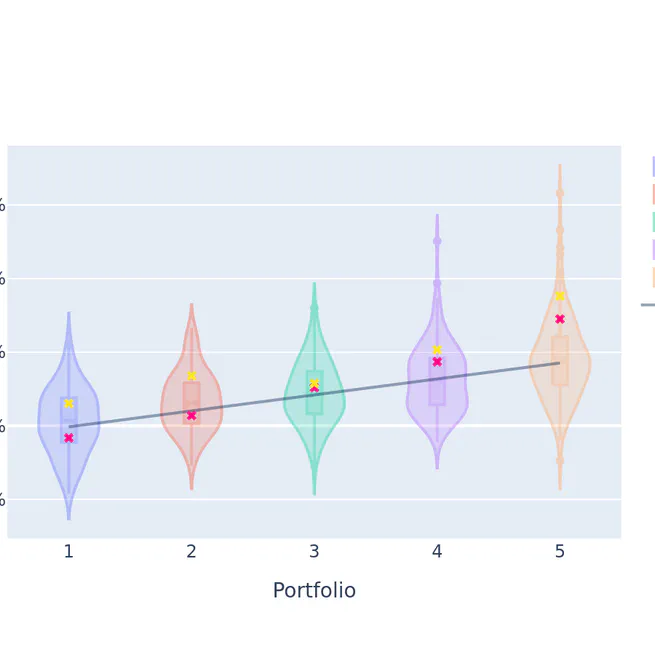

Factor Chasing and the Cross-Country Factor Momentum Anomaly

We document a cross-country factor momentum anomaly, which we term 'Factor Chasing'. Specialized style mutual funds chase factor returns across countries, but their trades are delayed, leading to positive returns that are not spanned by leading factor models.

2024-01-01