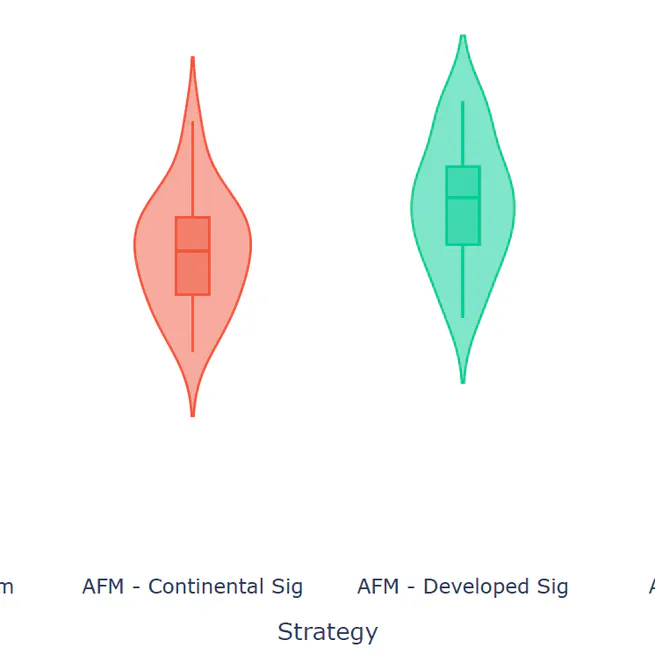

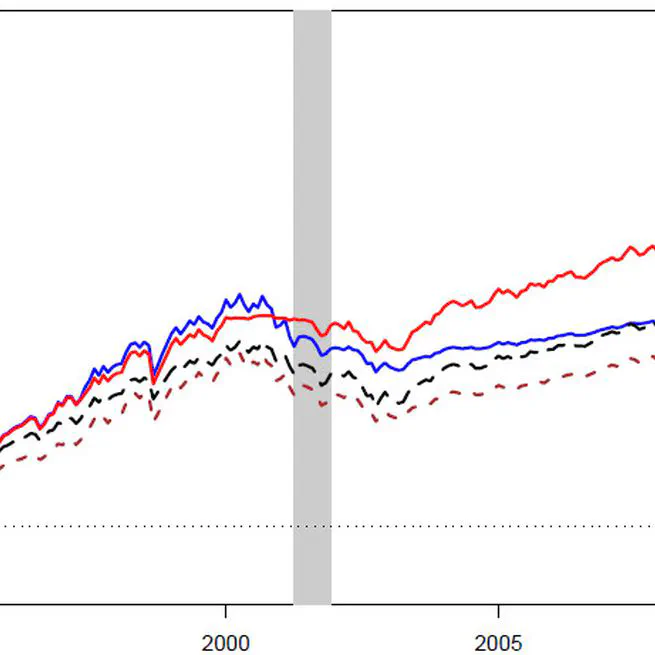

Regional and global factor momentum signals outperform local factors in forecasting risk premiums and revitalize momentum investing in less-integrated markets like Japan.

2024-04-01

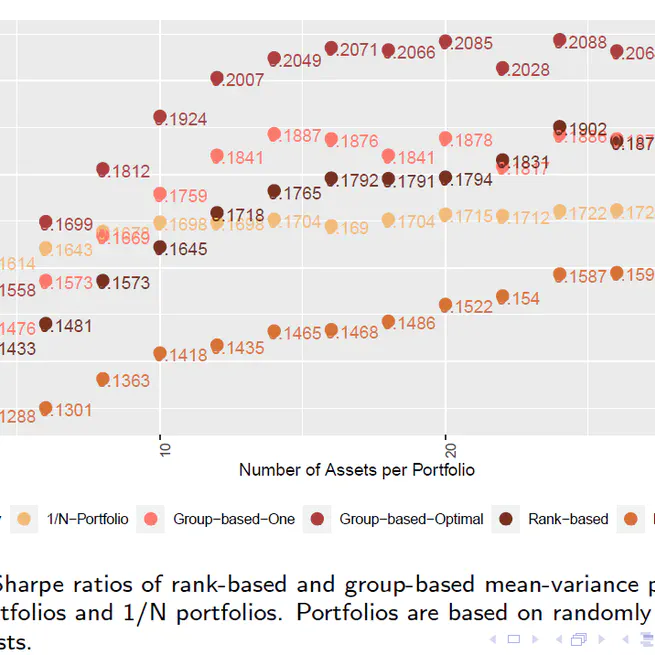

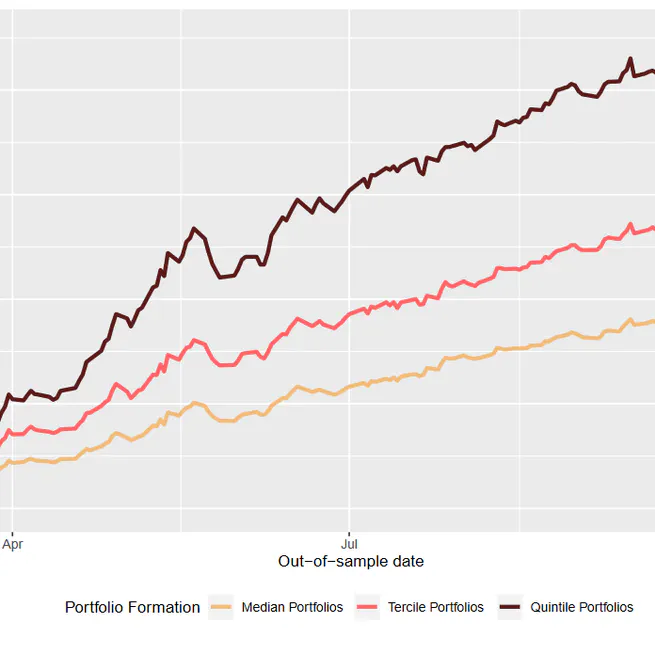

This paper proposes ranking-based portfolio optimization to mitigate the effects of parameter uncertainty, improving Sharpe ratios and reducing portfolio concentration.

2024-01-01

We offer a novel approach that aims at mitigating the crippling effects that parameter uncertainty and estimation errors have on the out-of-sample perforance of mean-variance optimized portfolios. We argue that investors should not rely on exact forecasts when optimizing portfolios but instead base their optimizations on ranking or grouping information and thereby implicitly reduce the informational content of their parameter inputs.

2024-01-01

We document a cross-country factor momentum anomaly, which we term 'Factor Chasing'. Specialized style mutual funds chase factor returns across countries, but their trades are delayed, leading to positive returns that are not spanned by leading factor models.

2024-01-01

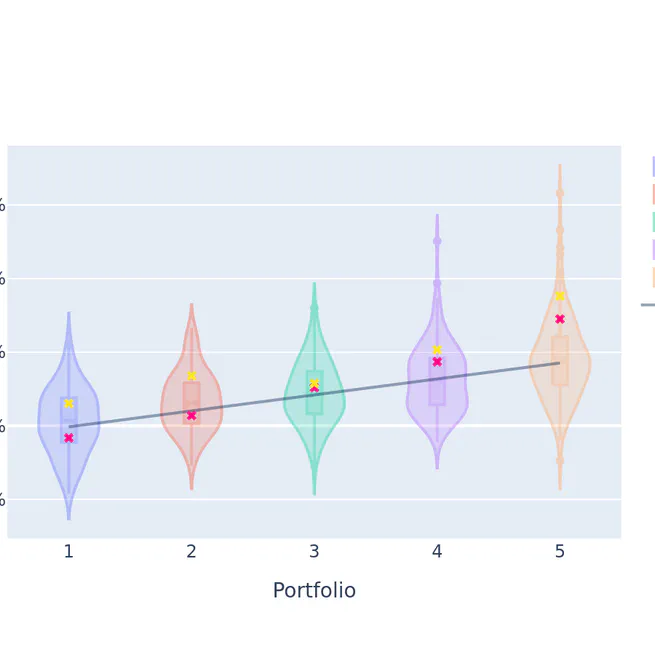

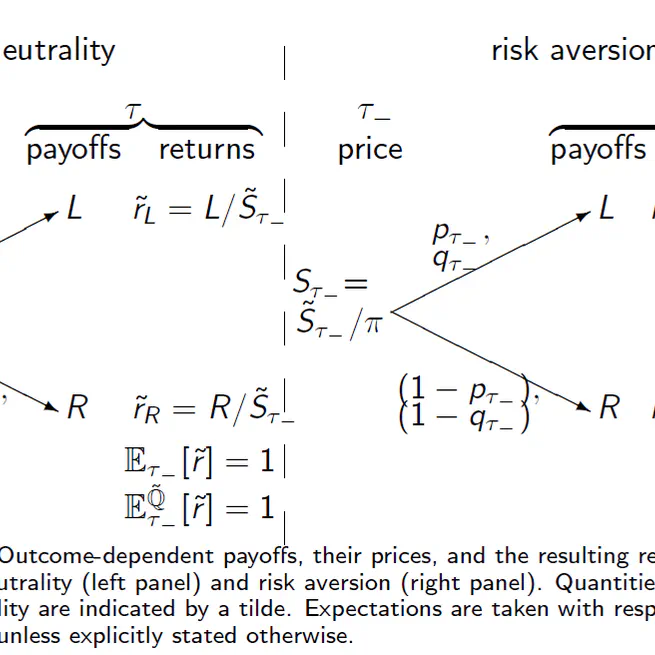

We analyze event risk premia in an expected utility framework and provide closed-form solutions under both quadratic and power utility for four different cases: Deterministic/stochastic conditional event returns, and deterministic/stochastic event outcome probabilities.

2024-01-01

We estimate crypto-related risk for U.S. banks using historical covariance with bitcoin returns, focusing on contagion from FTX's failure.

2023-09-01

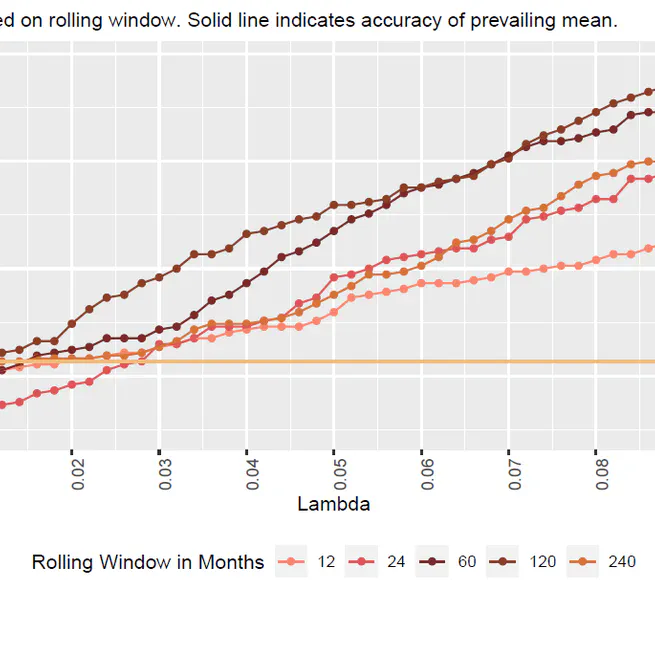

In this paper, we develop a novel, intuitive and objective measure of time-varying parameter uncertainty (PU) based on a simple statistical test.

2020-02-05

We show that parameter uncertainty based on the turbulence within each cross-section of factor portfolios produces a significant out-of-sample forecast for six out of seven tested Fama-French risk factors.

2018-07-28

Based on a multidisciplinary literature review, we discuss the assumptions implicit in the prevalent Black-Scholes model and argue for relaxed assumptions that better represent characteristics of uncertain IT projects.

2016-10-12