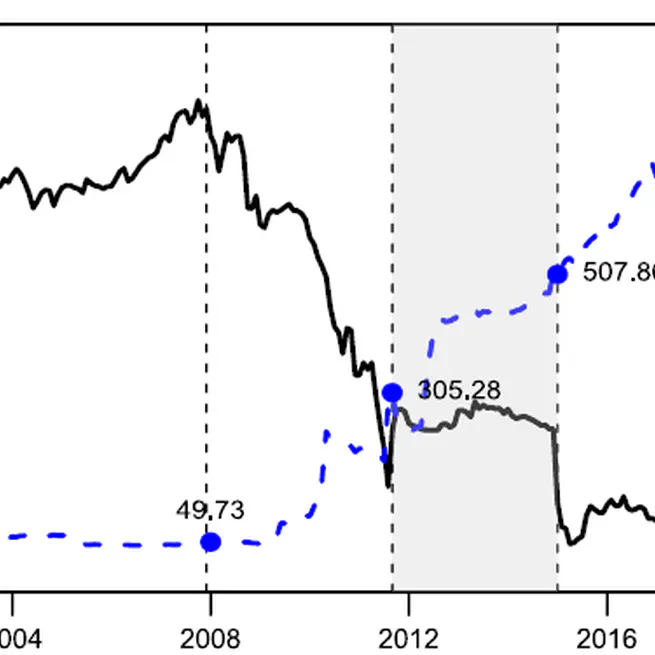

We analyze drivers of the EUR/CHF exchange rate in different regimes between 2000 and 2020, estimating structural breaks in an integrated way together with the drivers that are relevant during these subperiods.

2023-02-14

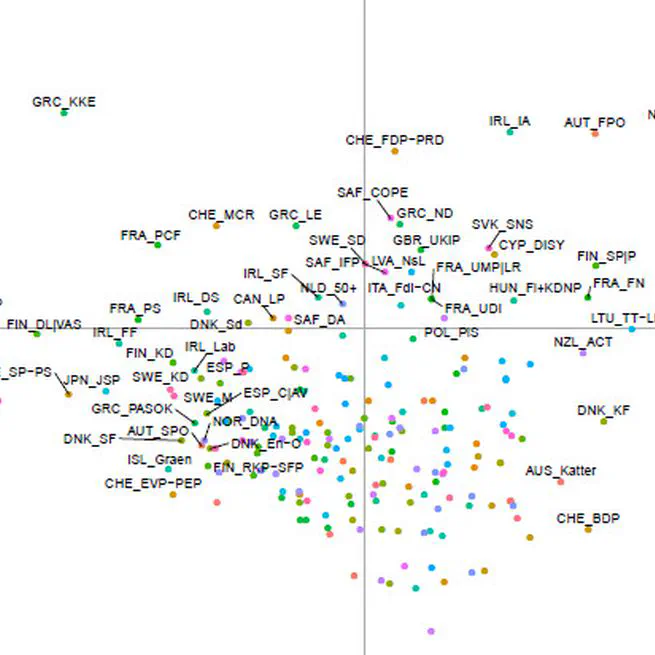

We examine the effect of populism on financial markets around national elections. We find that the electoral success of populist parties has a direct impact on volatility in major domestic market indexes with different signs depending on the political ideology of the populist parties.

2021-09-01

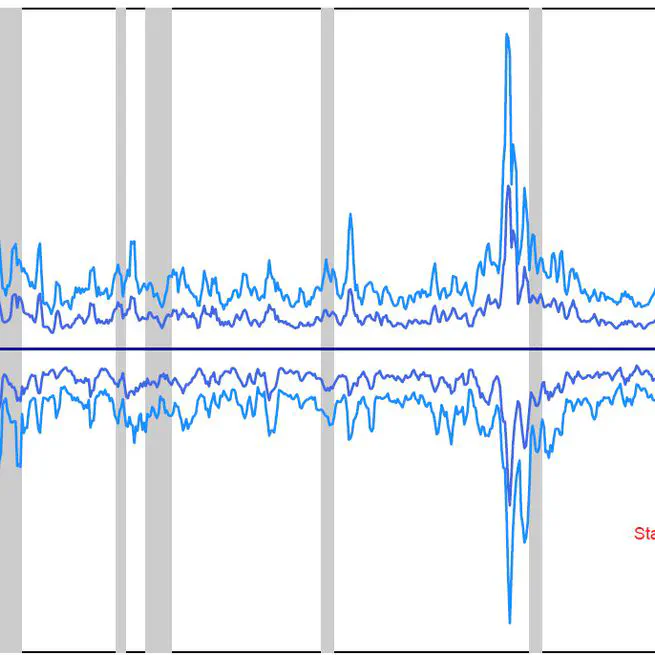

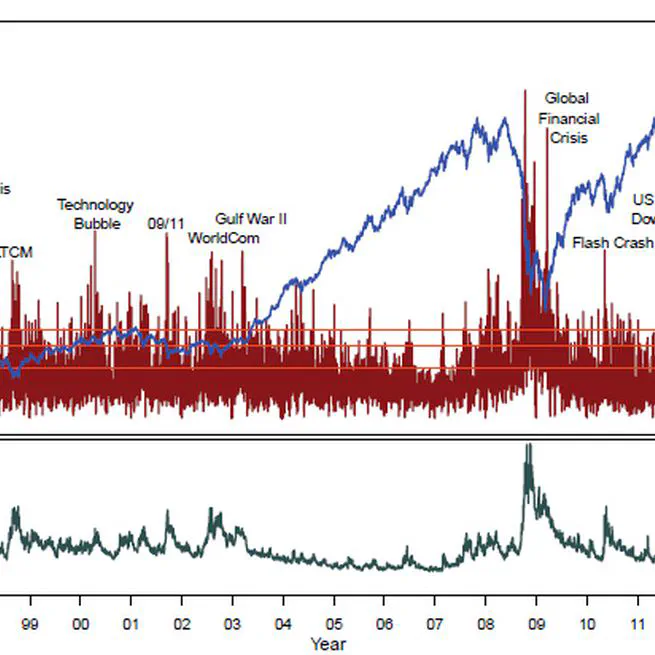

In this paper we investigate the predictive power of cross-sectional volatility, skewness and kurtosis for future stock returns.

2020-09-07

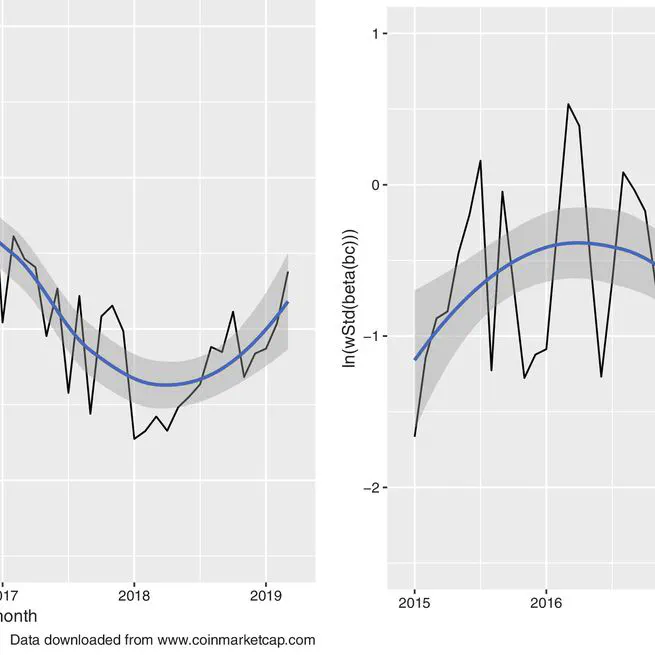

This paper investigates herding behavior in the crypto market. We consider the full, survivorship-bias free cross-section of cryptocurrencies, and document - against existing evidence - significant herding in this dataset. The effect is stronger, when using bitcoin as a *transfer currency*.

2020-03-01

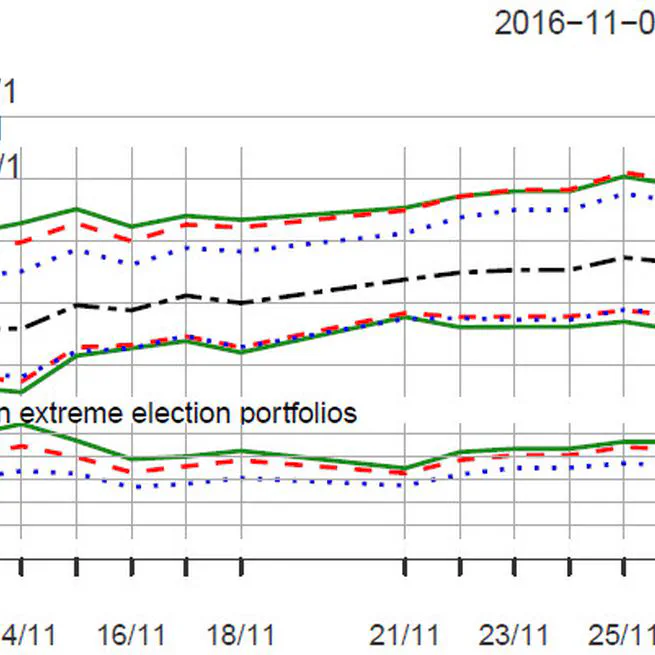

We use data from betting markets to analyze the sensitivity of stock returns to potential outcomes of political events such as elections. By classifying stocks into expected conditional winners and losers prior to such an event, we form portfolios that generate large positive returns after the event date, conditional on correctly anticipating the outcome. We illustrate this using data from the 2016 US presidential election and the 2016 Brexit referendum.

2020-02-25

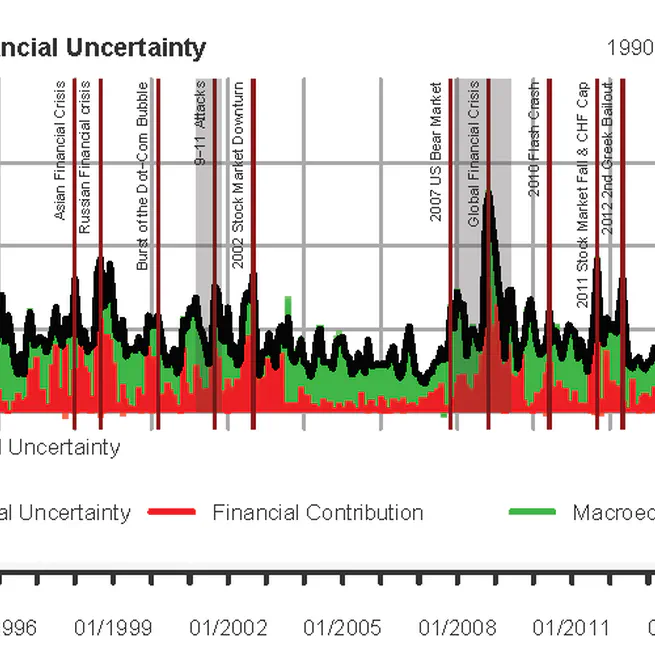

This paper introduces a novel measure of global macro-financial uncertainty and examines the state-dependent transmission of uncertainty to economic activity.

2020-01-21

In an unbalanced cross-country panel covering 169 nations and time-series records of up to 52 years we analyze drivers behind beer consumption.

2019-09-02

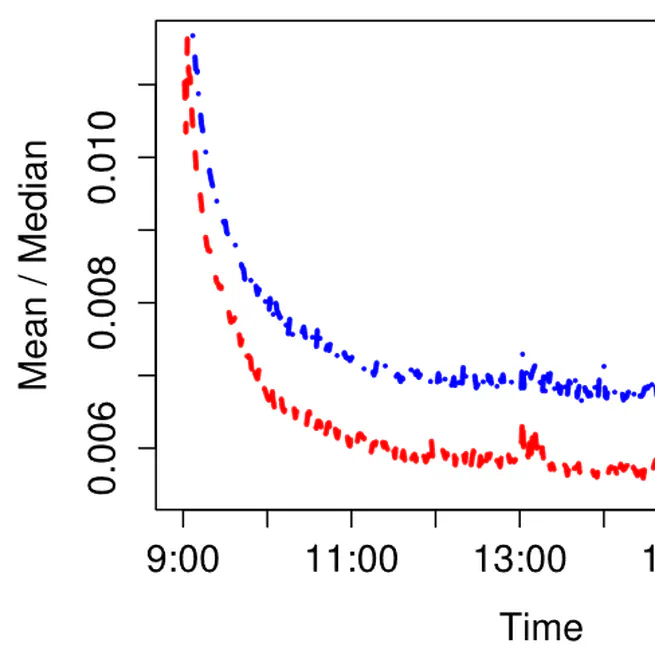

This paper explores the statistical and economical significance of intraday and -week patterns in bid-ask spreads.

2018-07-01

The purpose of this paper is to create a universal (asset-class-independent) portfolio risk index for a global private investor.

2017-02-03

Based on a thorough review of the literature, this paper discusses the assumptions of the Black-Scholes model and presents an advanced simulation model for the valuation of real options in IT investment projects.

2016-03-08