Estimating Crypto-Related Risk: Market-Based Evidence from FTX's Failure and Its Contagion on U.S. Banks

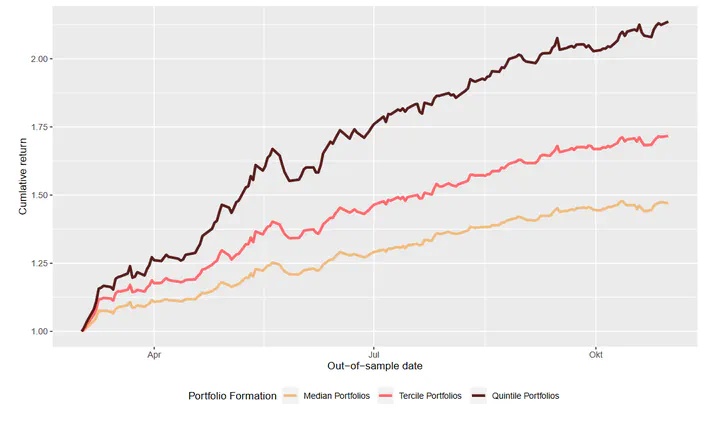

Out-of-sample evaluation of using long-short investments conditioned on the future movement of bitcoin. We construct median, tercile, and quintile portfolios based on daily calculated from January 1, 2022 until .

Out-of-sample evaluation of using long-short investments conditioned on the future movement of bitcoin. We construct median, tercile, and quintile portfolios based on daily calculated from January 1, 2022 until .Abstract

We use historical covariance between stock returns of U.S. banks and bitcoin returns to estimate a sensitivity measure that captures crypto-related risk in financial institutions. The measure effectively explains cross-sectional stock returns of 219 U.S.-based financial institutions in response to the failure of FTX on November 11, 2022. Overall, we document negative contagion effects on the market valuation of U.S. banks. We further show that this risk measure is unrelated to variables that have been used to explain operational risk in previous literature, i.e., corporate governance and business complexity. However, we document a significant relation with bank liquidity as measured by the Tier 1 capital adequacy ratio. We conclude that, on average, it is the banks with sufficient liquidity reserves that venture into the crypto sphere. Our approach offers individual investors and customers the opportunity to leverage market efficiency to evaluate the idiosyncratic level of crypto-related risk in a financial institution.

Type

Publication

Working Paper, University of Liechtenstein & TU Darmstadt