Factor Chasing and the Cross-Country Factor Momentum Anomaly

Conclusion

Our analysis reveals solid and robust factor chasing returns across global markets. Portfolios sorted by prior relative returns consistently generate high risk-adjusted returns, with factor chasing behavior evident across all examined formation periods, market conditions, and factor themes. We conduct various tests to uncover the origins of these factor chasing patterns, considering rational expectations, investor over- and under-reaction, and limits to arbitrage. Our findings indicate that factor chasing is more pronounced in markets with higher information frictions and greater limits to arbitrage.

Our results suggest that factor chasing strategies capitalize on market underreactions. Contrary to the positive feedback trading hypothesis, we observe that foreign investors tend to withdraw from markets with high prior factor returns. When analyzing mutual fund responses to factor chasing signals, we observe substantial variation across fund styles. Certain styles exhibit delayed, factor chasing trading behaviors, while others take a contrarian approach. This variation appears both in their loadings on global factor chasing strategies and in their country-level equity holdings within large global mutual funds.

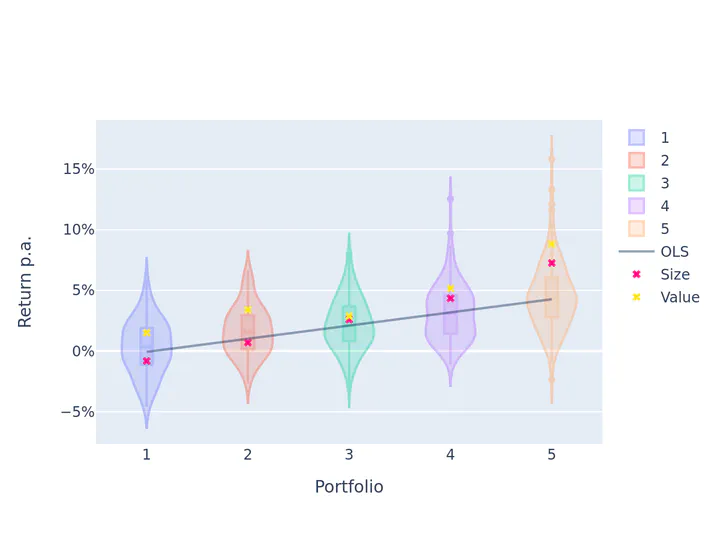

Factor chasing has a severe impact on factor momentum strategies. Trading on factor momentum in losing countries leads to negative average annual returns. Investors who seek to implement momentum trading in international markets should therefore consider factor chasing signals if not directly implementing factor chasing strategies.