The Price of Populism - Financial Market Outcomes of Populist Electoral Success

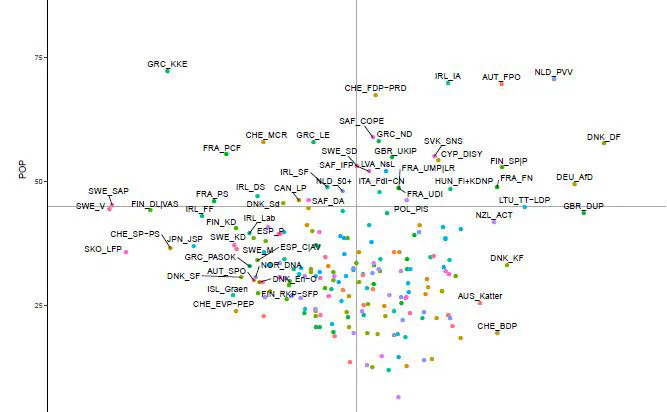

This figures plots the Populism score (POP) against the - centered - Left-Right score (PRILE) calculated according to Section 3.2 of the paper. All political information comes from the Comparative Manifesto project (CMP). We depict country-party combinations (labeled as country_party in abbreviated form) for the most recent election that we find in our election database (Table 2).

This figures plots the Populism score (POP) against the - centered - Left-Right score (PRILE) calculated according to Section 3.2 of the paper. All political information comes from the Comparative Manifesto project (CMP). We depict country-party combinations (labeled as country_party in abbreviated form) for the most recent election that we find in our election database (Table 2).Conclusion

This paper examines for a sample of Western style democracies, if political populism creates uncertainty that is priced in equity option markets, and whether these financial markets distinguish between populist movements on the basis of their ideology. To the best of our knowledge, it is the first to study these issues empirically. In order to do so, we compile a unique dataset of information on national elections, party programs, and prices of major equity index options. As hypothesized in the theoretical outline, we find that the immediate risk assessment made by financial markets varies for populist parties of different ideology: The electoral success of populist parties on the far left merely seems to bring higher risk assessments for economic fluctuations, but for the risk of an economic crash only under some specifications. This indicates that financial markets are partially suspicious of left-wing populism in the context of a high-income democracy, where important institutional guardrails are in place. In turn, findings show the electoral success of right-wing populist parties to be evaluated as unequivocally favorable by financial markets, both for price and tail risk. Given some of the doubtful economic policies frequently advocated by populism on the far right, for example protectionism and selective taxbrakes, this result probably reflects the explicit tendency of associating with rent-seeking interests and of catering to the political demands of big business. It should be noted here that our framework essentially does not permit claims on either, the long-run causal association of populism and financial markets, nor any possible effect of populism on financial market development in low- and middle-income countries. Sorting out these important questions is an intriguing and challenging task, which will have to be addressed by future research, when more and better data is hopefully available. Future data on political parties may also permit further differentiation between the economic policy intentions of different right-wing populist parties to uncover the complex interplay of pro- and anti-market elements that seems to be present in this group.