Higher Moments Matter! Cross-Sectional (Higher) Moments and the Predictability of Stock Returns

Image credit: Unsplash

Image credit: UnsplashAbstract

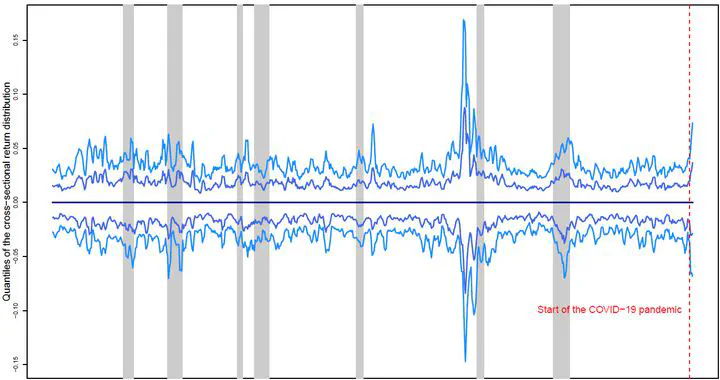

In this paper, we investigate the predictive power of signals imputed from the cross-section of stock returns—namely cross-sectional volatility, skewness, and kurtosis—to forecast the time series. Adding to the existing literature, which documents cross-sectional volatility to forecast a decline in the equity premium with high in- and out-of-sample predictive power, we highlight the additional role of cross-sectional skewness and cross-sectional kurtosis. Applying a principal component approach, we show that cross-sectional higher moments add statistically and economically significant to the predictive quality of cross-sectional volatility by stabilizing its predictive performance and yielding a positive trend in in-sample and out-of-sample predictive quality for the equity premium. Additionally, we show that cross-sectional skewness and cross-sectional kurtosis span the predictive power of cross-sectional volatility for disaggregated returns with respect to size and value.

Type

Publication

Review of Financial Economics 39(4), 455-481