Breaking Bad: Parameter Uncertainty Caused by Structural Breaks in Stocks

2024-01-01· ·

0 min read

·

0 min read

Lukas Salcher

Sebastian Stöckl

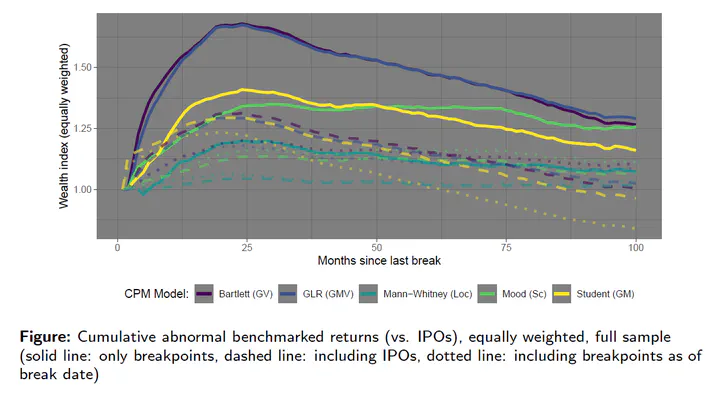

Cumulative abnormal benchmarked returns (vs. IPOs), equally weighted, full sample (solid line: only breakpoints, dashed line: including IPOs, dotted line: including breakpoints as of break date)

Cumulative abnormal benchmarked returns (vs. IPOs), equally weighted, full sample (solid line: only breakpoints, dashed line: including IPOs, dotted line: including breakpoints as of break date)Abstract

Estimating parameter inputs for portfolio optimization has been shown to be notoriously difficult and gets further complicated by structural breaks and regime shifts in financial data. We argue that these structural breaks ultimately result in parameter uncertainty, to which investors are averse. On an aggregate market level, this ambiguity-aversion gives rise to a premium for parameter uncertainty as stocks with high (low) parameter uncertainty are avoided/sold (more attractive/bought). We propose a novel measure called break-(adjusted stock-) age that proxies for parameter uncertainty and is based on detecting structural breaks in stock returns using unsupervised machine learning techniques. Our measure reveals (i) that break-age is priced significantly in the cross-section of stock returns and (ii) that break-age is a powerful proxy for parameter uncertainty.

Type

Publication

University of Liechtenstein