Are There Fences in the Global Factor Zoo?

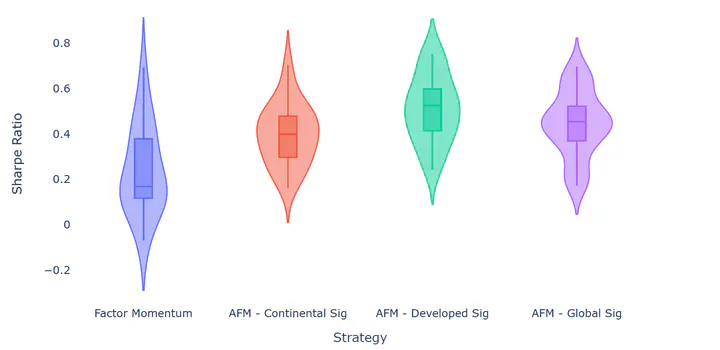

Violin plots for Sharpe ratios of different (advanced) factor momentum strategies: Standard vs. continental signal, vs. developed market signal vs. global signal.

Violin plots for Sharpe ratios of different (advanced) factor momentum strategies: Standard vs. continental signal, vs. developed market signal vs. global signal.In this study, we revisited the debate on the efficacy of local versus regional and global asset pricing models through the lens of factor predictability and momentum. By integrating factor momentum into our analysis, we demonstrate that regional and global signals exhibit superior predictive performance for time-varying expected returns, as evidenced by higher average Sharpe ratios and lower dispersion of these across markets. This simple, yet efficient method shows that factor predictability is a non-local phenomenon. Through a structural analysis, we provide evidence that the superiority of non-local models is likely attributable to cross-country factor co-movement. Notably, our findings reveal that regional and global factor signals not only offer a more robust framework for predicting asset returns but also have the unique ability to recreate momentum strategies in markets previously thought to be devoid of momentum opportunities, such as Japan. This suggests that the incorporation of regional and local country signals into empirical asset pricing can unlock previously unidentified momentum-based investment opportunities, thereby enriching the arsenal of strategies available to international investors. Furthermore, the outperformance of regional and global models over local models underscores the importance of considering broader, cross-border economic and financial indicators in (predictive) asset pricing.

In conclusion, our research contributes to the ongoing discourse on international asset pricing by highlighting the superior performance and practical benefits of adopting regional and global predictive signals. These findings not only challenge traditional views but also pave the way for future research to explore the intricate dynamics between factor predictability, momentum, and asset pricing on a global scale. As markets continue to evolve, it becomes imperative for asset pricing models to adapt accordingly, embracing a more holistic view that captures the complexities of global financial markets.