Cryptocurrencies: Herding and the transfer currency

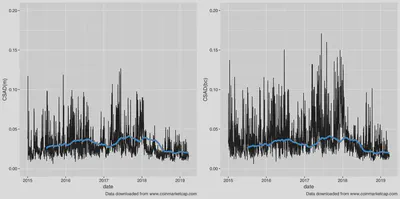

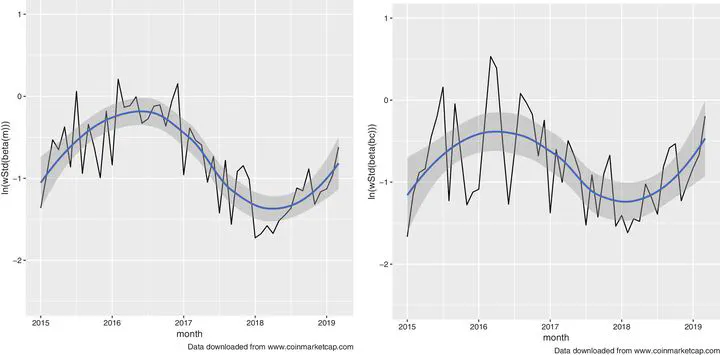

Evolution of value weighted cross-sectional beta dispersion in relation to two market proxies (value weighted market portfolio and bitcoin).

Evolution of value weighted cross-sectional beta dispersion in relation to two market proxies (value weighted market portfolio and bitcoin).Abstract

We contribute to the ongoing debate on the existence of herding behavior in the crypto market and provide statistically significant evidence thereof. This finding is in contrast to existing empirical evidence in this field, which is primarily due to previous studies suffering from a sample bias. By introducing the concept of beta herding to the debate, we provide further robustness for our results. Moreover, we propose the concept of Bitcoin as a transfer currency and empirically show that herding measures centered around such a transfer currency provide a more precise representation of dispersion in investors beliefs on the crypto market.

Type

Publication

Finance Research Letters, 33

Highlights

- This paper investigates herding behavior in the crypto market.

- We consider the full, survivorship-bias free cross-section of cryptocurrencies.

- Against existing evidence, we document significant herding in this dataset.

- This effect is stronger, when using bitcoin as a ‘transfer currency’.