Political Event Portfolios

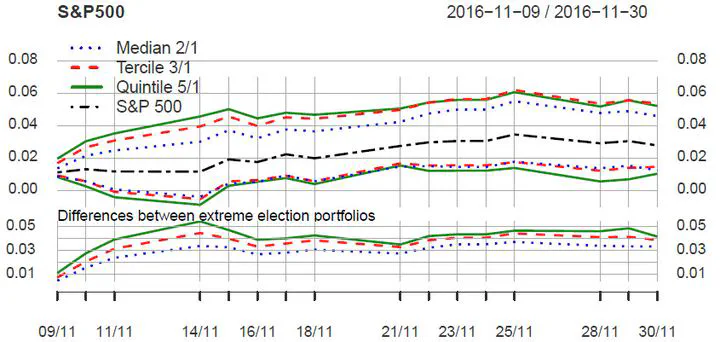

Extreme (top and bottom quantile) election portfolios and corresponding long-short portfolios for the US presidential election 2016. The upper part of the plot shows the cumulative returns of the top and bottom median (blue & dotted), tercile (red & dashed) and quintile (green & solid) value-weighted portfolios that are built by sorting on θi from Eq. (2). The lower part of each plot shows the cumulative returns of long-short portfolios, which are formed from the extreme quantile portfolios. For reference purposes, we also provide the cumulative performance of the corresponding index (S&P 500 and FTSE 350) in black (dot-and-dash).

Extreme (top and bottom quantile) election portfolios and corresponding long-short portfolios for the US presidential election 2016. The upper part of the plot shows the cumulative returns of the top and bottom median (blue & dotted), tercile (red & dashed) and quintile (green & solid) value-weighted portfolios that are built by sorting on θi from Eq. (2). The lower part of each plot shows the cumulative returns of long-short portfolios, which are formed from the extreme quantile portfolios. For reference purposes, we also provide the cumulative performance of the corresponding index (S&P 500 and FTSE 350) in black (dot-and-dash).Conclusion

In this paper, we have shown how to classify the cross-section of stocks into expected winners and losers around political events by combining event outcome probabilities from betting markets (political prediction markets) with stock price data. Compared to previous literature, our approach selects profitable portfolios prior to the event from a large cross-section of stocks, without relying on firm-specific variables that may only be available for a subset of these stocks. Instead, we use a simple and parsimonious model which infers all required information directly from stock prices and betting odds. Aside from forming portfolios designed to benefit from a particular event outcome (“candidate baskets”), the approach can also be used to measure the sensitivity of existing portfolios to the event outcome and to remove any undesired corresponding exposure. Moreover, prior to political events, the approach also provides the possibility to check whether or not stock prices reflect any outcome-dependent return expectations. The approach has been applied to the constituents of major US and UK stock indices, using data that were publicly available before the 2016 US presidential election and the 2016 Brexit referendum. Long-short portfolios constructed according to this approach show strong outperformance around the election date, which is both economically and statistically significant. The stock sensitivities estimated from our model show low correlations to firm-specific variables which have been used successfully in the previous literature analyzing these events. In both datasets, we find postevent return drift, which has been documented previously for these events but is outside of the scope of our model. Using both regression approaches and double-sorted quantile portfolios, we show that stock sensitivities to betting odds contain incremental information compared to both firm characteristics and first-day returns.