Parameter Uncertainty, Financial Turbulence and Aggregate Stock Returns

2020-02-05· ·

0 min read

·

0 min read

Sebastian Stöckl

Preprint

Cite

Poster

Frontiers of Factor Investing 2020*

Cologne Colloquium on Financial Markets 2020*

Asset Allocation under Parameter Uncertainty 2017

Workshop of the AWG 2017

DGF 2017

FMA Europe 2017

Australasian Finance & Banking 2016

SFA 2015

World Finance 2015

UBC Sauder (Vancouver)

HSG (St. Gallen)

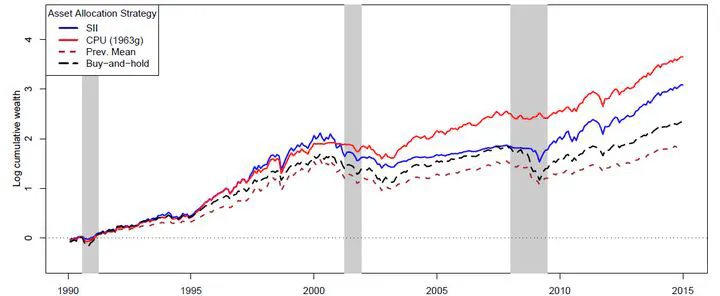

LOg cumulative wealth of various investment strategies, including buy & hold, based on SII as well as parameter uncertainty.

LOg cumulative wealth of various investment strategies, including buy & hold, based on SII as well as parameter uncertainty.Abstract

In this paper, we develop a novel, intuitive and objective measure of time-varying parameter uncertainty (PU) based on a simple statistical test. Investors who are averse to parameter uncertainty will react to elevated levels of PU by withdrawing from the market and causing prices to fall, a behavior that is well described by the model of portfolio selection with parameter uncertainty of Garlappi et al. (2007). We show that this model in combination with our measure, outperforms all other tested variables including the strongest known predictor to date. Additionally, it is the only predictor that fulfills all criteria generally expected from a stable predictor of the equity premium. All our results are statistically and economically significant and robust to a large variety of different specifications.

Type

Publication

Working Paper (University of Liechtenstein)